november child tax credit schedule

The Low Income Housing Tax Credit Program LIHTC is a federally authorized program for non-profit and for-profit developers to promote the construction and rehabilitation of affordable rental housing. Goods and services tax harmonized sales tax GSTHST credit.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

. 345 400 415 430 445 500. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. Goods and services tax harmonized sales tax GSTHST credit.

You may be able to claim the credit even if you dont normally file a tax return. The new advance Child Tax Credit is based on your previously filed tax return. The CRA makes Canada child benefit CCB payments on the following dates.

Includes related provincial and territorial programs. This Clinic Seminar Demonstration Schedule is printed months in advance of the event and is therefore subject to change. November 11 2021 142 PM 2 min read.

Below is the full Child Tax Credit payment schedule for the rest of this year as outlined by the IRS. November child tax credit payment schedule Monday July 11 2022 Edit. See what makes us different.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. If your child is not a qualifying child for the Child Tax Credit you may be able to claim the 500 Credit for Other Dependents for that child when you file 2021 your tax return. With the November payments still on their way to some families this is an updated list of the 2021 Child Tax Credit advance payments schedule.

The Child Tax Credit helps families with qualifying children get a tax break. December 13 2022 Havent received your payment. IR-2021-222 November 12 2021.

The advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. Learn More At AARP. November 18 2022.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000 per child for kids 6 to. November 12 2021 1126 AM CBS DFW. The combined payments -- 325 for individuals or 650 for married couples filing jointly -- will be included in one paper check.

The MTSP Income Limits are used to determine qualification levels as well as set maximum rental rates for. Over the course of six months last year millions of eligible families received monthly checks for up to 300 from the expanded child tax creditParents can expect more money with their tax. For more information about the Credit for Other Dependents see the.

Multifamily Tax Subsidy Projects MTSP Income Limits were developed to meet the requirements established by the Housing and Economic Recovery Act of 2008 Public Law 110-289 that allows 2007 and 2008 projects to increase over time. Ad File a free federal return now to claim your child tax credit. If you qualify for the advance Child Tax Credit you can expect your next payment to hit your bank account by Nov.

Up to 300 dollars or 250 dollars. Canada child benefit payment dates. If you received advance Child Tax Credit payments in.

Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents. Most parents automatically get the enhanced credit of up to 300 for each child up to. But many parents want to.

November 11 2021 142 PM 2 min read. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. That drops to 3000 for each child ages six through 17.

November 15 and December 15 are the last two days for monthly. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040.

We dont make judgments or prescribe specific policies. October 5 2022 Havent received. 3600 per child under 6 years old.

The Low Income Housing Tax Credit LIHTC was created by Congress under Section 252 of the Tax Reform Act of 1986 to promote the construction. Wait 5 working days from the payment date to contact us. It will take the state until early October to print all 17.

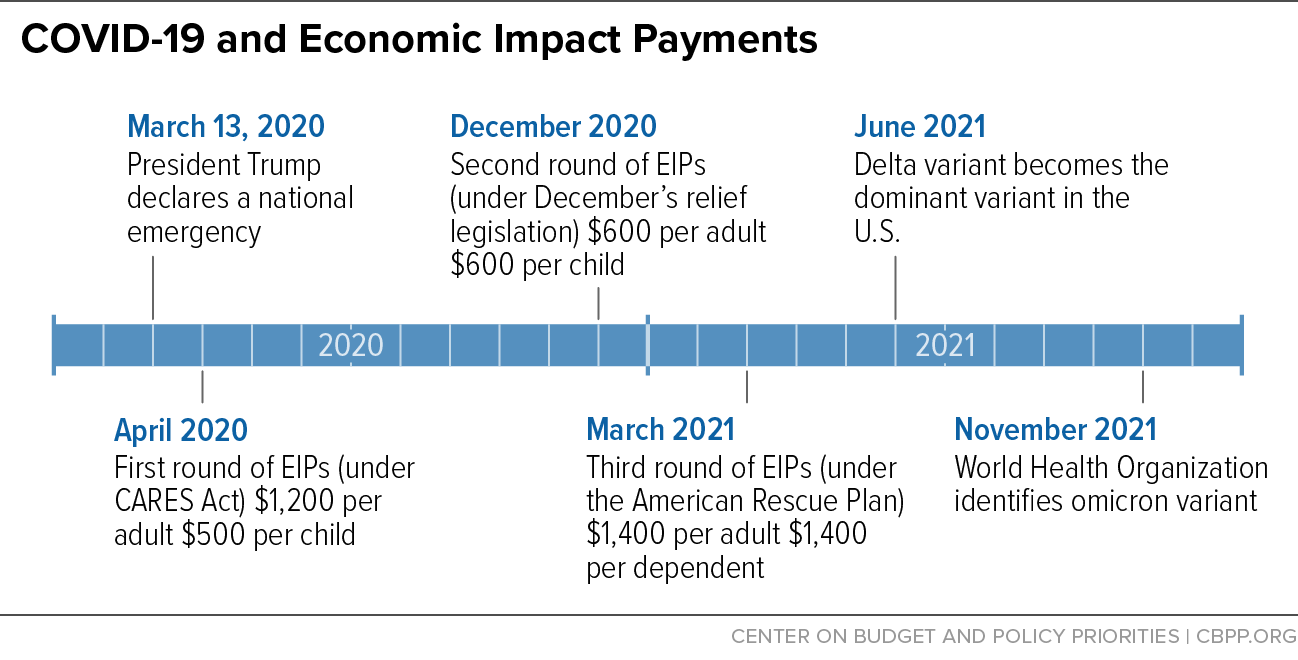

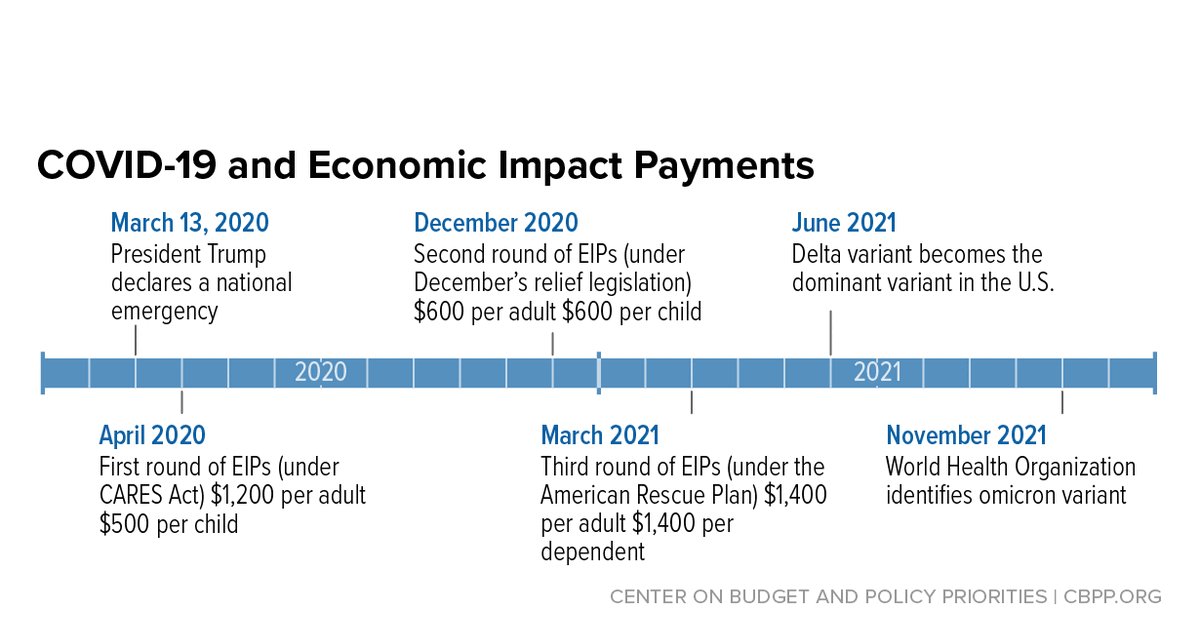

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

Pearson Edexcel Past Papers A Level History Of Art November 2021 All Question Papers Mark Scheme In 2022 Question Paper Past Papers A Level History

Add Sizzle To Your Dining Experience With The Sizzler Festival At Cafe Treat And Puran Da Dhaba Thepridehotels Ahmedabad From 3rd 23 Biryani Kebab Entrees

Download Uae Vat Debit Note Excel Template Exceldatapro Excel Templates Debit Templates

U Of Michigan Football Stadium Seating Chart Neyland Stadium Seating Chart With Row And Seat Michigan Football Football Stadiums Chart

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Scholastic Book Fair Book Fair Scholastic Book

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

45 Sponsorship Letter Templates Word Pdf Google Docs Sponsorship Letter Letter Template Word Letter Templates

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Budget Pie Chart Money Personal Finance November 2019 Finance Saving Budgeting Emergency Fund

When Will The 2021 Child Tax Credit Payments Start Under Stimulus Relief The Turbotax Blog

Accounting Worksheet Template Spreadsheet Template Excel Spreadsheets Templates Budget Spreadsheet